A Tesco Bank loan offers a simple way to borrow money with fixed monthly payments and an easy online application process.

Whether you’re planning a big purchase or consolidating debts, it provides clarity and control over your finances.

This guide explains how the Tesco Bank loan works, who is eligible to apply, and what rates and terms to expect.

About Tesco Bank

Tesco Bank is a UK-based financial institution known for its digital-first approach. It offers a range of online banking and loan services.

It operates as a subsidiary of Tesco Group, one of the largest retail chains in the country.

With millions of customers, Tesco Bank has built a strong reputation in personal finance for convenience, transparency, and customer service.

Loan Features at a Glance

Here’s a quick look at the key features that make a Tesco Bank loan a practical choice for personal borrowing:

- Loan amounts: Borrow between £1,000 and £35,000.

- Loan terms: Choose repayment periods from 1 to 7 years.

- Fixed monthly payments: Helps you plan your budget with no surprises.

- Representative APR: From 6.1% on loans between £7,500 and £15,000 (subject to status).

- No setup fees: Tesco Bank doesn’t charge arrangement or application fees.

- Early repayment option: You can pay off your loan early, with a charge of up to 2 months’ interest.

- Joint applications: An option may be available for applying with a co-borrower.

- Change payment date: Flexibility to adjust your repayment schedule.

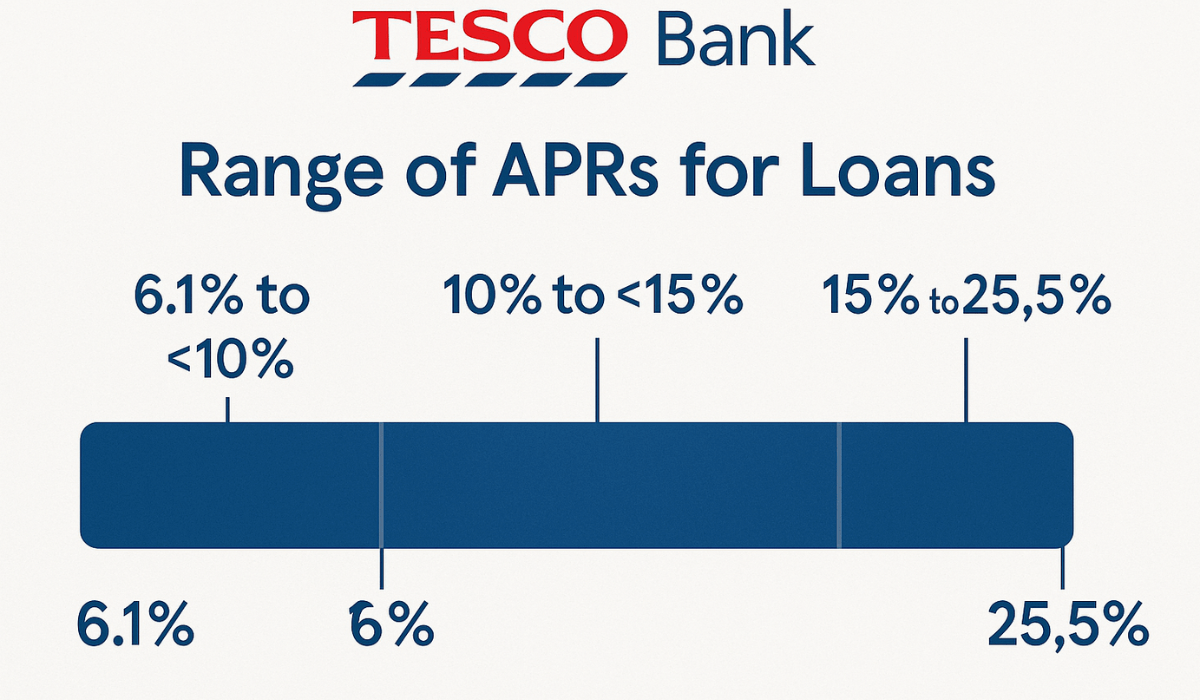

Interest Rates and Fees

Knowing the interest rates and fees helps you plan costs and avoid surprises. Here’s a quick breakdown:

Interest Rates

- Representative APR: 6.0% for loans between £7,500 and £25,000 over 1 to 5 years, available to Clubcard members.

- APR Range: 6.0% to 34.5%, depending on loan amount, term, and credit profile.

- Fixed Interest: All loans have a fixed interest rate, which ensures that your monthly payments remain the same throughout the loan term.

Fees

- Arrangement Fees: Tesco Bank does not charge any arrangement or setup fees for personal loans.

- Early Repayment: If you repay your loan early, you may be charged up to two months’ interest.

- Late Payment Charges: A fee of £12 is applied each time a loan payment is late, and an additional £12 if a default notice is issued.

How to Apply Online

Applying for a Tesco Bank loan online is quick and straightforward. Follow these simple steps to complete your application from the comfort of your home:

- Visit the Tesco Bank website: Go to the personal loans section to start your application.

- Choose your loan amount and term: Use the loan calculator to select how much you need and over how many years.

- Check your eligibility: Tesco Bank offers a soft credit check that won’t affect your credit score.

- Complete the online form: Fill in your personal details, employment information, and monthly income.

- Submit your application: Review your details and submit. You may receive a decision instantly or within 24 hours.

- Accept the offer: If approved, review the terms and confirm to receive the funds, often by the next working day.

Eligibility Requirements

To be successful in your application, you must meet specific basic criteria.

These requirements help ensure that applicants are financially capable of repaying what they borrow:

- Age: You must be at least 18 years old.

- Residency: You need to be a permanent UK resident.

- Income: A regular income is required to support repayments.

- Credit status: You should have a good credit history and not be bankrupt or under a debt management plan.

- Bank account: A UK bank account with a valid debit card is necessary.

- Employment: Typically, being employed, self-employed, or retired with a stable income meets the requirement.

Credit Impact and Soft Check Option

Before applying, it’s helpful to understand how checking your eligibility affects your credit score.

Tesco Bank offers a soft check tool that gives you a risk-free way to explore your options:

- Soft Credit Check: You can check your eligibility without impacting your credit score.

- Instant Feedback: Quickly decide whether you’re likely to be approved before applying.

- No Obligation: Using the soft check doesn’t commit you to the loan.

- Full Check Later: A hard credit search is only performed if you proceed with the whole application.

- Useful for Comparison: This feature helps you compare loan options safely across different lenders.

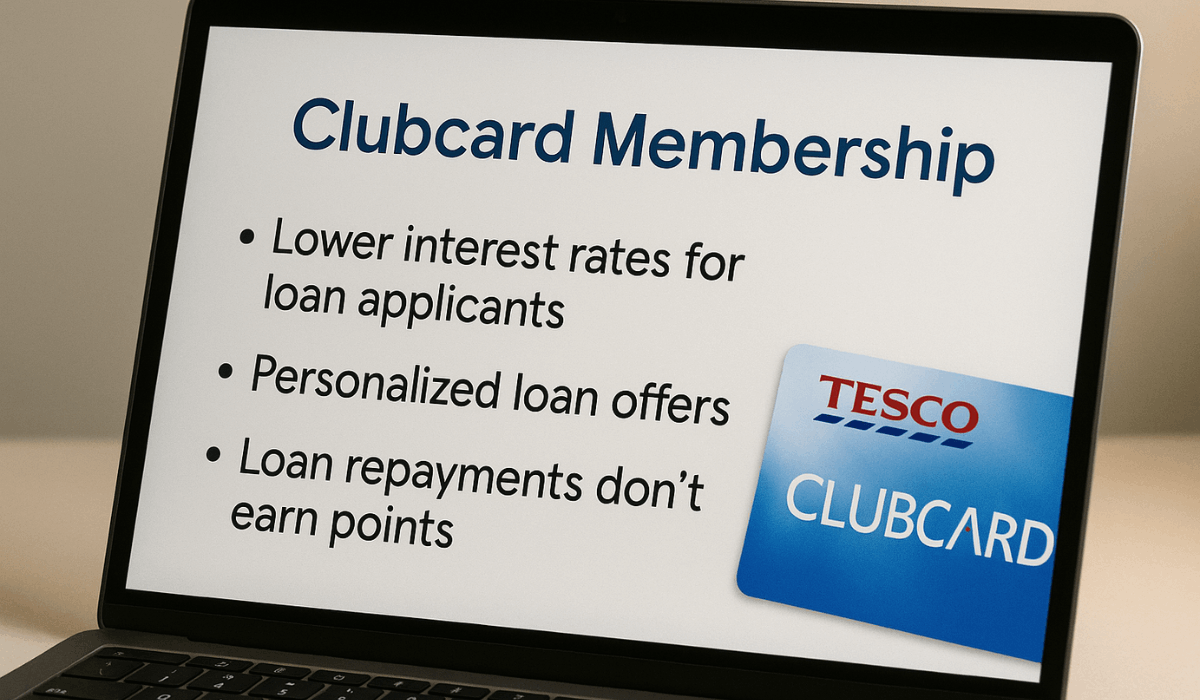

Clubcard Membership Perks: Lower Rates, Not Points

Clubcard membership may offer added value when you borrow, but knowing what to expect is essential.

While you won’t earn points from repaying a loan, being a Clubcard holder can still provide meaningful advantages:

- Lower Interest Rates: Clubcard members often qualify for more competitive APRs on eligible loan amounts.

- Personalized Offers: Members may receive tailored loan deals based on shopping and banking history.

- No Points on Repayments: Unlike spending on Tesco credit cards or Clubcard Pay+, Loan payments do not earn Clubcard points.

- Other Tesco Bank Products: You can still collect points using other financial services, like Tesco Bank credit cards or Clubcard-linked debit cards.

- Reward Exchanges: Points earned elsewhere can be redeemed through Clubcard Reward Partners for travel, dining, and entertainment savings.

Contact Information

If you need assistance or have questions about your loan, Tesco Bank offers several ways to contact you. Here are the main contact options available:

Phone Support

- Loans Customer Service: 0345 600 6016

- Available Monday to Friday: 8 am – 8 pm; Saturday and Sunday: 9 am – 3 pm

- Online & Mobile Banking Help: 0345 300 3511

- Available Monday to Friday: 8 am – 9 pm; Saturday and Sunday: 8 am – 6 pm

- Financial Difficulty Support: 0345 301 4971

- Available Monday to Thursday: 8 am – 7 pm; Friday: 8 am – 6 pm; Saturday: 8 am – 2 pm

Calls may be recorded. These numbers may be included in any inclusive call minutes provided by your phone operator.

To Sum Up

A Tesco Bank loan offers a simple, secure way to borrow with fixed payments and a fully online process.

With flexible terms, no setup fees, and the option for Clubcard members to access better rates, it’s a reliable choice for personal financing.

If the features meet your needs, visit the official site and start your application today.

Disclaimer

Loan approval and interest rates are subject to credit status, affordability checks, and individual circumstances.

Always review the full terms and conditions on the official Tesco Bank website before applying.