Sainsbury’s Loan offers flexible personal financing with competitive fixed rates and exclusive perks for Nectar cardholders.

You can borrow between £1,000 and £40,000 and repay in manageable monthly installments.

You may access better rates and earn additional rewards by linking your Nectar account.

Key Features of Sainsbury’s Loan

Here are the key features of Sainsbury’s loan, which is designed to offer flexibility and added value—especially for Nectar members.

These features make it a practical option for covering planned or unexpected expenses:

- Borrow from £1,000 to £40,000.

- Choose repayment terms from 1 to 7 years.

- Fixed interest rates, so monthly payments stay the same.

- No fees for early repayment, giving you complete flexibility.

- Exclusive lower rates for Nectar cardholders.

- Simple online application process.

- Use the loan calculator to preview rates before applying.

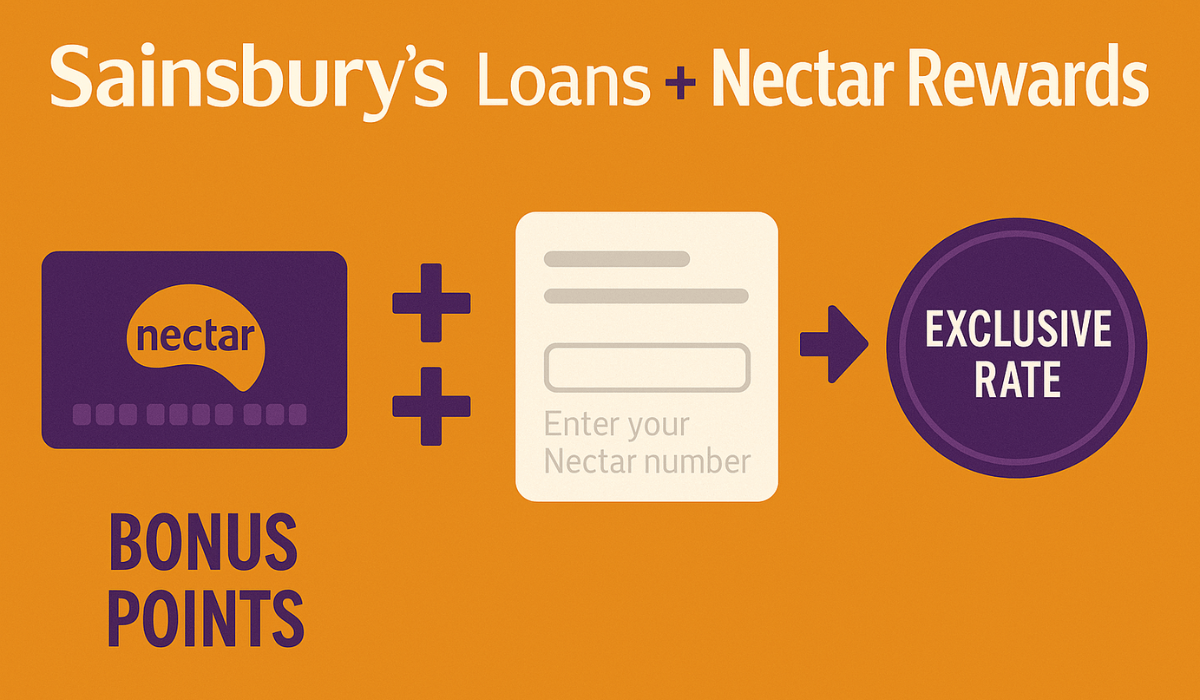

Nectar Rewards Integration

The loan stands out by offering benefits from the Nectar Rewards program.

If you’re a Nectar member, you can unlock more competitive rates and earn extra value by linking your account. Here’s how the integration works:

- Exclusive rates: Nectar cardholders may receive lower APRs compared to non-members.

- Linking is easy: Enter your Nectar number during the loan application.

- More points: Some loan-related offers may come with bonus Nectar points.

- Tailored offers: You might receive personalized loan promotions through your Nectar account.

- Ongoing benefits: Keep your Nectar account active to continue enjoying these advantages.

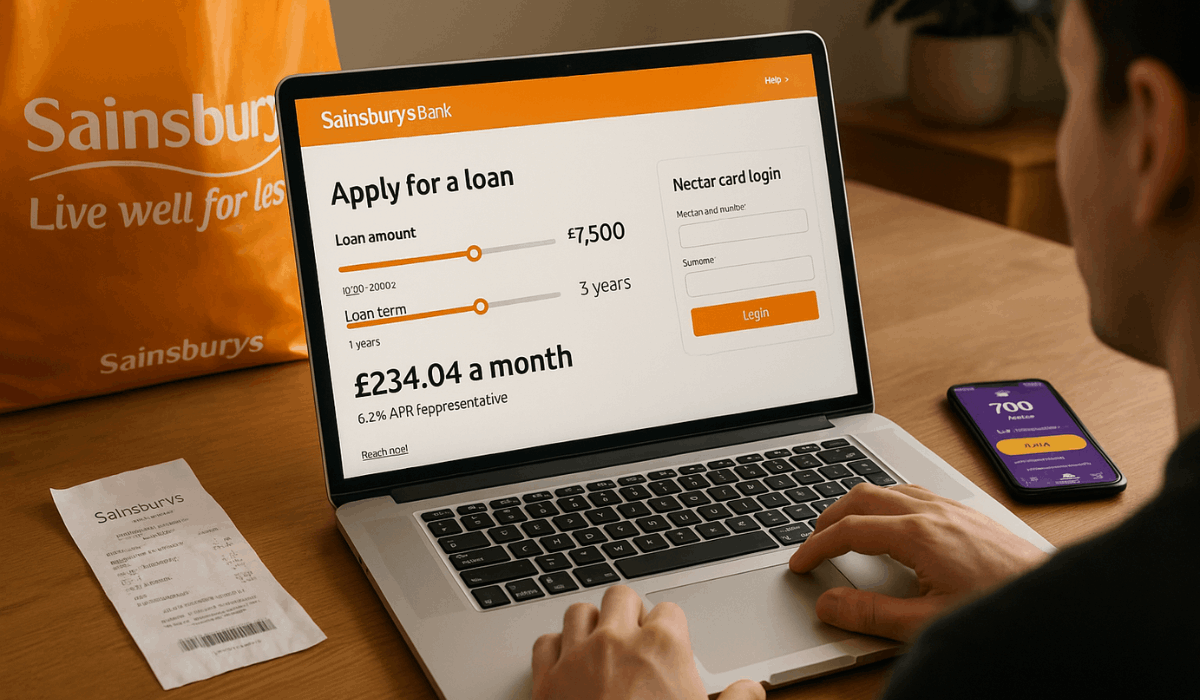

Interest Rates and Fees

Before applying for a Sainsbury’s Loan, it’s essential to understand the interest rates and any associated fees.

Rates vary based on your credit profile and whether you’re a Nectar member. Here’s a breakdown of what to expect:

- Representative APR: Starting from 6.2%, depending on loan amount and creditworthiness.

- Maximum APR: Up to 26.5% for smaller loan amounts or lower credit scores.

- Nectar members often qualify for lower, exclusive rates.

- No arrangement fees: You won’t be charged for setting up the loan.

- No early repayment fees: Pay off your loan early with no penalties.

- Late payment charges: May apply if you miss a scheduled payment (details in the loan agreement).

Eligibility Criteria

You must meet specific eligibility criteria to qualify. These requirements help ensure that you can manage repayments responsibly.

Below is a straightforward list of the key conditions you must satisfy:

- Age Requirement: You must be between 18 and 76 years old at the time of application.

- Residency: You must be a permanent UK resident.

- Nectar Card Membership: You need to have a Nectar card to apply.

- Bank Account: You must hold a UK-based bank or building society account that allows direct debits.

- Credit History: A good credit record with no county court judgments or bankruptcy history is required.

- Employment Status: You must be employed for over 3 months or retired with a pension. Self-employed applicants aren’t eligible.

- Income Level: You need a yearly income of at least £7,500 before tax from sources like salary, pension, or investments.

- Purpose of Loan: The loan must not be used for business purposes, property purchases or deposits, investments, or gambling.

How to Apply for a Sainsbury’s Loan

Applying for a Sainsbury’s loan is quick and entirely online.

The process is designed to be simple, especially if you have a Nectar card. Follow these steps to get started:

- Eligibility Check: Use the online calculator to see if you qualify and what rate you may get.

- Visit Website: Go to Sainsbury’s Bank’s official site and choose “Personal Loans.”

- Select Amount & Term: Enter how much you want to borrow and for how long.

- Enter Nectar Details: Log in or provide your Nectar card number for better rates.

- Fill Out Application: Complete the form with your personal and financial information.

- Upload Documents: Provide proof of income, ID, or other required documents.

- Submit Application: Send your form for review—some decisions are instant.

- Accept Offer: If approved, review the terms and confirm acceptance.

- Receive Funds: Approved loans are usually paid out within 1–2 working days.

Repayment Options

Sainsbury’s Bank offers flexible repayment options to help you manage your loan effectively.

Whether you want to adjust your payment schedule, make extra payments, or settle your loan early, here are the available choices:

- Monthly Direct Debit: Make fixed payments each month by direct debit.

- Change Payment Date: Request a new date at least 14 days before your next due date.

- Overpayments: Pay extra to reduce your loan term or monthly amount.

- Early Settlement: Repay the whole loan anytime—ask for a settlement quote online.

- Online Loan Management: Check balances, make payments, and manage your loan through online banking.

Customer Support and Contact Information

If you need assistance with your loan, there are several support options available:

- General Loan Inquiries: Call 0345 788 8444 for questions about your loan account.

- Payment Difficulties: Having trouble paying? Call 08085 40 50 60, open Mon–Fri 8 am–8 pm, Sat–Sun 8 am–6 pm.

- Arrears Support: For accounts already in arrears, call 0800 056 0565, Monday to Friday 8 am–8 pm, and Saturday 8 am–4 pm.

- Online Banking Help: For issues with online banking, call 08085 40 50 60 or send a secure message through your online account.

- Complaints: To file a complaint, call 08085 40 50 60 or write to Sainsbury’s Bank, PO Box 4955, Worthing, BN11 9ZA

Tips Before Applying

Before applying, it’s smart to prepare and improve your chances of approval. Here are some helpful tips to follow:

- Check your credit score: Know where you stand before applying.

- Register your Nectar card: You’ll need it to access exclusive rates.

- Use the loan calculator: Estimate monthly payments and total costs.

- Review your income and expenses: Make sure you can afford repayments.

- Avoid multiple loan applications: Too many checks can hurt your credit score.

- Prepare the required documents: Have your ID and proof of income ready.

- Compare loan options: Make sure Sainsbury’s offers the best deal for your needs.

Loan Use Cases

Sainsbury’s loans can be used for various everyday needs or major expenses.

Here are the most common ways borrowers use their loan funds:

- Debt Consolidation: Combine multiple debts into one fixed monthly payment.

- Home Improvement: Fund renovations, repairs, or upgrades around the house.

- Major Purchases: Buy appliances, furniture, or electronics without using credit cards.

- Special Events: Cover costs for weddings, holidays, or milestone celebrations.

- Emergency Expenses: Manage sudden costs like medical bills or urgent repairs.

- Vehicle Purchase: Buy a new or used car without dealership financing.

- Education Costs: Pay for courses, training programs, or school-related expenses.

To Wrap Up

Sainsbury’s Loan offers flexible terms, fixed rates, and added value through Nectar rewards.

It’s a practical choice for managing major expenses or consolidating debt.

Check your eligibility online today and apply for exclusive member benefits.

Disclaimer

All loans are subject to status, affordability checks, and terms and conditions.

Interest rates and offers may change and are not guaranteed until your application is approved.