HSBC Personal Loans offer a simple way to borrow money for personal goals, such as home renovation, debt consolidation, or a major purchase.

With competitive fixed interest rates and no setup fees, the loan is designed for flexibility and convenience.

This guide will show you how to apply and what to expect.

Key Features of HSBC Personal Loan

HSBC Personal Loan comes with flexible terms and clear conditions, making it a practical choice for many borrowers.

Here are the main features you should know:

- Loan Amount: Borrow from £1,000 to £25,000 (or local equivalent).

- Fixed Interest Rates: Your rate stays the same throughout the term.

- Flexible Repayment Terms: Choose repayment periods from 1 to 5 years.

- No Arrangement Fees: No setup or processing charges.

- No Early Repayment Penalty: Pay off your loan early without extra fees.

- Quick Online Application: Apply through the website or mobile app.

- Fast Funding: Approved loans may be funded on the same day.

- Manage Online: Track and manage your loan via online banking.

Interest Rates and Fees

The loan offers varying interest rates and fees depending on your country of residence, loan amount, and customer profile.

Here’s an overview of the rates and fees across different regions:

Interest Rates

- Representative APR: 6.4% for loans between £7,500 and £20,000.

- Loan Terms: Repayment periods range from 1 to 5 years for loans up to £15,000 and up to 8 years for loans over £15,000.

- Maximum APR: Depending on your personal financial circumstances, the highest APR you could be offered is 22.9%.

Fees

- Arrangement Fee: HSBC does not charge an arrangement or setup fee for personal loans.

- Early Repayment: You can make overpayments or repay your loan early without penalty.

- Late Payment Charges: If you miss a repayment, you may be charged interest on the overdue amount plus any administration fees.

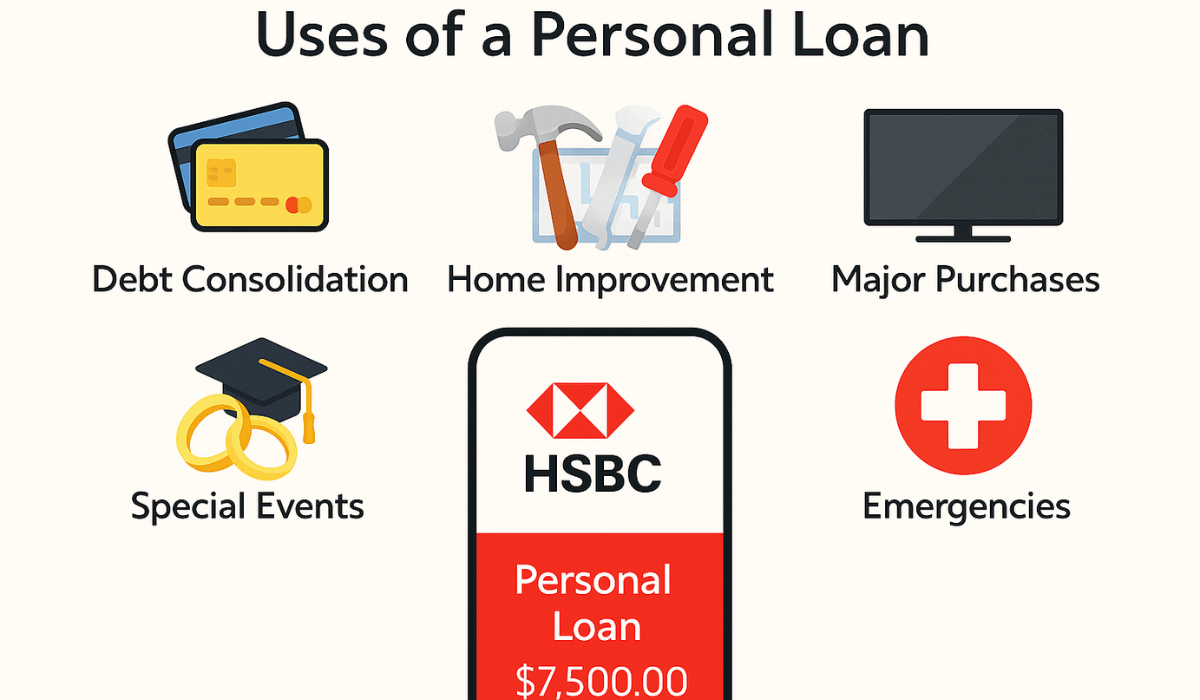

Common Uses for HSBC Personal Loan

It is designed to help you cover various personal expenses with ease and flexibility.

Whether you’re planning for something big or managing unexpected costs, here are some of the most common ways people use these loans:

- Debt Consolidation: Combine multiple debts into one manageable monthly payment with a lower interest rate.

- Home Renovation: Upgrade your kitchen, bathroom, or living space without dipping into your savings.

- Major Purchases: Finance furniture, appliances, or electronics you need now.

- Weddings and Events: Cover the costs of weddings, family celebrations, or other special occasions.

- Travel and Holidays: Fund your dream vacation with fixed repayments.

- Medical Expenses: Pay for procedures, treatments, or emergencies not covered by insurance.

- Education Support: Handle tuition fees, course materials, or training costs.

Eligibility Requirements

You must meet a few basic conditions before applying for an HSBC Personal Loan.

These help ensure you’re in a good position to manage your repayments. Here’s what you need:

- Be at least 18 years old.

- Have a regular income of at least £10,000 per year before tax.

- Be a UK resident with a valid UK address.

- Hold a bank or building society account with a Direct Debit facility.

- Have a good credit history with no recent defaults or bankruptcies.

- Be able to pass HSBC’s credit and affordability checks.

Application Process

Here’s a simple step-by-step list to apply for this loan, whether you’re applying online, through the mobile app, or in a branch:

- Step 1: Check if you meet the eligibility requirements.

- Step 2: Use HSBC’s loan calculator to get a quote (no impact on your credit score).

- Step 3: Gather your documents (ID, proof of income, and address).

- Step 4: Apply online via the HSBC mobile app, phone, or at a branch.

- Step 5: Wait for approval and credit assessment.

- Step 6: Review and accept the loan offer.

- Step 7: Receive the funds in your bank account.

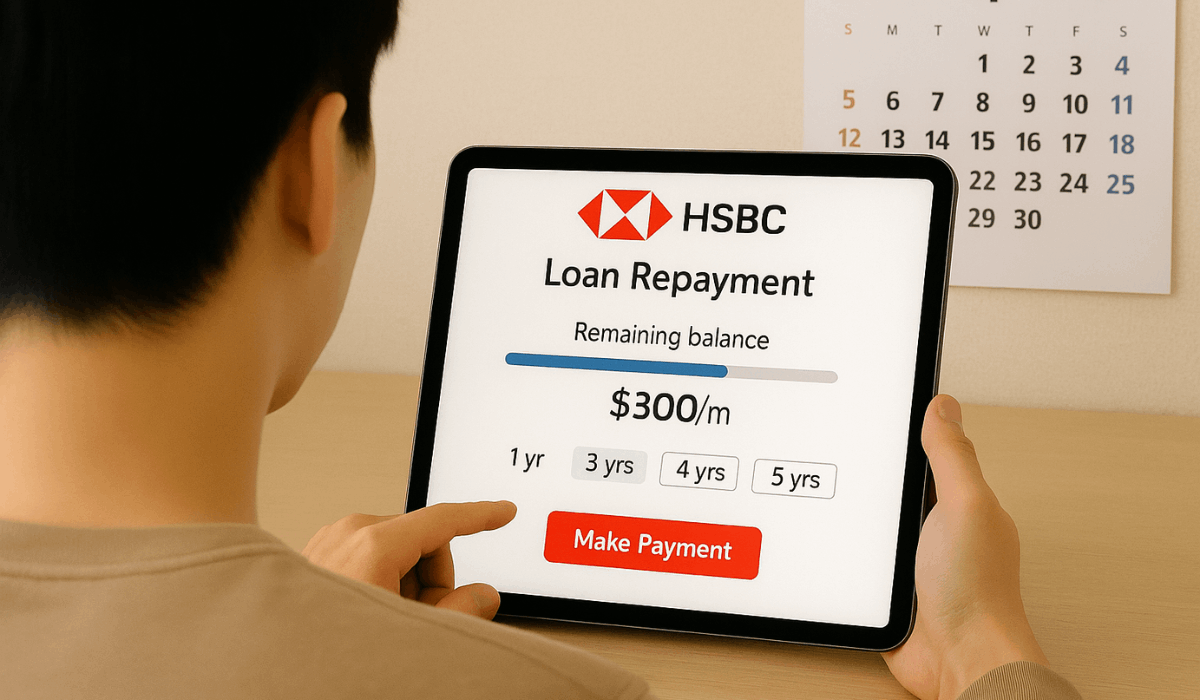

Repayment Options

HSBC offers flexible repayment options, helping you stay on track with your budget. Here’s how you can manage your repayments:

- Fixed Monthly Payments: Pay the same amount each month over 1 to 8 years.

- Early Repayment: You can repay the full loan with no extra fees.

- Overpayments: Make extra payments anytime to finish the loan faster and save on interest.

- Payment Deferral: If you’re facing financial difficulty, you can sometimes delay payments (this must be arranged with HSBC).

Contact and Support Information

If you need assistance with your HSBC Personal Loan or have any questions, here are the ways you can get in touch:

Phone Support:

- Personal Banking: Call 03457 404 404 (UK) or +44 1226 261 010 (from abroad). Lines are open daily from 08:00 to 20:00.

- Premier Customers: Call 03457 707 070 (UK) or +44 1226 260 260 (from abroad). They are available 24/7.

Online Chat:

- Log in to the HSBC Mobile Banking app, select the ‘Support’ tab, then ‘Chat with us’ for quick assistance.

Branch Visit:

- Use the Branch Finder to locate your nearest HSBC branch and speak to someone in person.

Mail Correspondence:

- Write to: Customer Service Centre, BX8 1HB, United Kingdom.

Tips for a Successful Application

Preparing well and meeting the key requirements is important to boost your chances of getting approved for an HSBC Personal Loan.

Here are some practical tips to help you apply with confidence:

- Check your credit score before applying to ensure it’s in good shape.

- Use HSBC’s loan calculator to preview your monthly payments.

- Only borrow what you need and can realistically afford to repay.

- Have all documents ready, including ID, proof of income, and address verification.

- Make sure your income is stable and meets the minimum requirement.

- Clear any outstanding debts, if possible, to improve your credit profile.

- Apply on a weekday for quicker processing and support availability.

The Bottomline

HSBC Personal Loans offer a reliable way to finance your needs with flexible terms and clear repayment options.

The application process is simple; you can manage everything online or in person.

To start, visit HSBC’s official website and apply for your loan today.

Disclaimer

Loan approval, interest rates, and terms are subject to HSBC’s assessment of your financial situation and credit history.

Always review HSBC’s official website for the latest terms and conditions before applying.